September 19, 2011

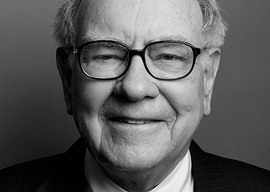

Warren Buffett

Lamentably, the sole individual with a more insatiable need for attention than Buffett happens to sit at 1600 Pennsylvania Avenue. So on September 19, 2011, Barack Obama announced the “Buffett Rule,” which would impose higher taxes on so-called millionaires.

Buffett never tires of proclaiming he pays lower taxes than his employees. His constant exemplar of a secretary makes $60,000 annually—a respectable salary, yet not particularly generous as contrasted against running paperwork for one of the planet’s most active executives. Buffett himself makes approximately $46 million per year. And this is how the man who would care for all Americans provides for his own? Noblesse oblige begins at home, Warren.

Often unmentioned is that Buffett’s tax rate is so low due to his income from long-term investments. For people actually earning over $373,000 due to their diligence and ingenuity as opposed to receiving their income from interest, the actual taxation stands at 35% in federal assessments alone. Who knew that being a “millionaire” began so low?

Warren doesn’t state whether he is to assume any extraordinary liabilities of this country’s non-paying by utilizing the line on the American tax return whereupon one can voluntarily contribute beyond what is assessed. He is encouraged to make use of this assumption with all due haste so long as he donates his money and not our own.

Yet most infuriating about the entire debacle of debate is that in this Punch and Judy show in Washington, each continues to refer to the measure as making people “pay their fair share.” In this general notion, the author is in complete agreement. But we tend to disagree about who is not already paying that “fair share.”

What of the over 50% of American citizens who pay no income taxes whatsoever? Is zero percent their “fair share”? If so, one begs to differ. These are the very people who most avail themselves of social services of every kind. Not only do they pay nothing to begin with, they proceed to strip the system bare of the very things which those unpaid taxes so readily provide.

Moreover, there are a host of families (we shall call them “the middle class”) who pay the very most yet derive the very least from the current system of American government. These are those who make just enough money not to qualify for anything from anyone. No food assistance, no housing assistance, no tuition assistance, and definitely no assistance from the likes of Buffett and his cohorts. There is no evidence the Buffett tax will do anything for these, except to make finding a new or better job more difficult and making the prospect of working as diligently as they already do even less appealing since their potential reward will diminish.

Buffett continues his unabated demonization of the developers, inventors, and producers. It is a grotesque farce that so many contribute absolutely nothing to society (except possibly crime and unwanted children) yet endlessly devour its resources and never pay so much as a shilling into the till.

The only fair assessment would be if everyone contributes a share. It doesn’t need to be much, it needn’t even be equal, but it does need to be something.

Before Buffett blathers on anymore with his half-baked notions of what is morally just, one would recommend that he bother to read a book. Malthus said it best, though hundreds have stated the same. Perhaps most succinctly, indulging the weak hobbles the able.

We are not faced with a dilemma of the very few who have “only” one-third up to one-half of their annual income appropriated by an overreaching government, but are instead grappling with the enormity of ingrates who pay naught yet demand even more from workers otherwise forced to subsidize them.

The problem in America is with non-payers, not with millionaires. But we could certainly do with one less billionaire being bothersome to the the nation’s productive people.