If you want to boost TV ratings, nothing does the trick like teen sex. Just think of poor Chris Hansen, who spent years building a respectable career as a TV newsman but since 2004 has become forever typecast as the guy who busts Internet perverts on NBC’s To Catch a Predator“with “What are you doing here?“ as his “you”re busted” calling card.

That kind of stuff is surefire Nielsen magic, and it doesn”t matter that in reality a teen victim is far more likely to be molested by a teacher or a coach than by some creepy stranger they encounter in an online chat room. The formula “teen + sex + crime” is luridly irresistible. Once Hansen did the first show, he was inevitably required to do dozens more, so that no matter what other big stories he reports, viewers will forever picture him surprising the chat-room cockroaches that crawl into his hidden-camera trap seeking the (fictional) 13-year-old bait.

More cleverly exploiting the same genre is Greta Van Susteren of FOX News, who has turned the May 2005 disappearance of high-school senior Natalie Holloway into a permanent excuse for “investigative” excursions to Aruba. Every other week, it seems, we see Greta standing beneath the swaying palms, earnestly describing her latest “update” on the case. If Natalie had been run over by a bus in Aruba, the story wouldn”t have merited a single national headline, but the disappearance of an attractive 18-year-old blonde trips the “teen + sex + crime” trigger in such a way that Greta can keep going back to Aruba over and over again.

With the exception of the New York Post“I’D BE YOUR ‘LOLLIPOP’: SLEAZY E-MAILS FROM MARRIED ASSEMBLYMAN TO TEEN INTERN“most newspapers don”t go in for that kind of stuff.

You”d certainly never find an esteemed publication like the New York Times blatantly working the “teen + sex + crime” angle with leering headlines and suggestive prose. No, whenever the gang at 620 Eighth Avenue wants to do teen sex, they generally do it from the social-science perspective, and so the headline Sunday was, “The Myth of Rampant Teenage Promiscuity“ with health writer Tara Parker-Pope assuring Times readers that “in many ways, today’s teenagers are more conservative about sex than previous generations.”

The Times story was in reaction to a Jan. 7 report from the National Center for Health Statistics. “The birth rate for teenagers 15″19 years increased 3 percent in 2006, interrupting the 14-year period of continuous decline from 1991 through 2005,” the NCHS reported.

The NCHS report had sparked a predictable round of media hand-wringing when it was released. USA Today reported: “Some blame a more sexualized culture and greater acceptance of births to unmarried women. Others say abstinence-only sex education and a possible de-emphasis on birth control may play a part.” Sarah Brown of the National Campaign to Prevent Teen and Unplanned Pregnancy perceived a cultural shift: “In the last couple of years, we had Jamie Lynn Spears. We had Juno and we had Bristol Palin. Those three were in 2007 and 2008 and not in 2005 to 2006, but they point to that phenomenon.”

Given the sort of spin that most media put on the 102-page report, Parker-Pope of the Times obviously felt a need to debunk the alarmist fear-mongering. She cited previous reports showing that the percentage of girls ages 15-17 who reported having had sexual intercourse actually declined from 38 percent in 1995 to 30 percent in 2002. And she enlisted the sort of “expert” opinion that is indispensible to respectable social-science reporting, with University of LaSalle sociologist Kathleen Bogle providing the pooh-pooh quote: “There’s no doubt that the public perception is that things are getting worse, and that kids are having sex younger and are much wilder than they ever were. … But when you look at the data, that’s not the case.”

Well, that settles it, eh? Despite the blip in teen pregnancy, teenagers actually aren”t screwing around so much. Another “myth” busted by the New York Times!

The skeptical reader raises an eyebrow. Less teen sex, more teen mothers? Skepticism is arguably justified. Social science cannot provide a perfect measurement of how much sex teenagers are actually having. The fundamental problem is the reliability of self-reported survey data about sex. “Sex being an extremely private matter, it is nearly impossible to verify self-reported data about sexual behavior, and some self-reports are certainly false,” as one noted authority recently wrote.

In contrast to the necessary ambiguity of self-reported survey results, birth statistics are solid data, and that data confirms that some teenager are, we might say, living la vida loca.

The big news in NCHS report was that Mississippi had reclaimed its accustomed No. 1 status as America’s teen pregnancy capital, supplanting Texas, which had led the nation in 2004. According to the NCHS data, in 2006, the three states with the highest teen birth rates were Mississippi (68.4 births per 1,000 females ages 15-19), New Mexico (64.1 per 1,000) and Texas (63.1).

“Hmmm,” says the skeptical reader. “Perhaps demographics may be a factor?”

Again, the skeptic is on the right track. Plow through the NCHS report and you discover find is that the birth rate per 1,000 females 15-19 breaks down like this:

White………26.6

Black……….63.7

Hispanic….83.0

Teen motherhood occurs more than three times as often among Hispanics, and more than twice as often among blacks, than among whites. And according to the Census bureau, the population of Mississippi is 37.1 percent black and 1.8 percent Hispanic, whereas Texas is 11.9 percent black and 35.7 percent Hispanic, and New Mexico is 2.5 percent black and 44.0 percent Hispanic. By comparison, the state with the lowest teen birth rate, New Hampshire, is 95.8 percent white.

So while some liberals spun the NCHS report as reflecting the failure of the abstinence-only approach to sex education, demographic influence seems much more explanatory. (Perhaps the abstinence-only curricula would be more effective en Espanol?)

According to the NCHS, there were 441,822 babies born to females under age 20 in 2006. Of these, 148,125 were born to Hispanic mothers, 106,187 were born to black mothers, and 170,996 were born to non-Hispanic white mothers. So whereas non-Hispanic whites are 66 percent of the U.S. population, they contributed only 38 percent of babies born to teen mothers. The differential is even more dramatic among the youngest teens. Of the 6,396 babies born in 2006 to girls 14 and younger, 2,456 (38 percent) were born to Hispanics, 2,462 (38 percent) were born to blacks, and 1,647 (20 percent) were born to non-Hispanic whites.

None of that data appeared in the New York Times‘s story, which in nearly 900 words didn”t even acknowledge the demographic factor in teen pregnancy statistics. Chris Hansen keeps trapping Internet pervs, Greta Van Susteren keeps flying down to Aruba to explore the Mystery of the Missing Blonde, and the New York Post (we assume) eagerly awaits the next teen-sex scandal of “Long Island Lolita“ proportions, but the much larger “scandal“ remains remarkably underreported.

Standing before the Siegessaule, the Victory Column that commemorates Prussia’s triumphs over Denmark, Austria, and France in the wars that birthed the Second Reich, Barack Obama declared himself a “citizen of the world” and spoke of “a world that stands as one.”

Globalists rejoiced. And the election of this son of a white teenager from Kansas and a black academic from Kenya is said to have ushered us into the new “post-racial” age.

Are we deluding ourselves? Worldwide, the mightiest force of the 20th century, ethnonationalism”that creator and destroyer of nations and empires; that enduring drive of peoples for a nation-state where their faith and culture is dominant and their race or tribe is supreme—seems more manifest than ever.

“Vote Reflects Racial Divide” ran the banner in the Washington Times over Tuesday’s story datelined, “Santa Cruz, Bolivia.” It began:

“The Bolivian vote to approve a new constitution backed by leftist President Evo Morales reflected racial divisions between the nation’s Indian majority and those with European ancestry.”

Provinces where mestizo and Europeans predominate voted down the constitution. But it carried with huge majorities the Indian tribes of the western highlands, for this constitution is about group rights.

In 2005, Morales came to office resolved to redistribute wealth and power away from Europeans to his own Aymara tribe and other “indigenous peoples” he contends were robbed by the Europeans who began to arrive 500 years ago, in the time of Columbus.

Pizarro’s victory over the Incan Empire is to be overturned.

According to Article 190 of the new constitution, Bolivia’s 36 Indian areas are authorized to “exercise their jurisdictional functions through their own principles, values, culture, norms and procedures.”

Tribal law is to become provincial law, and national law.

Gov. Mario Cossio of Tarija, which voted no, says the new constitution will create a “totalitarian regime,” controlled through an “ethnically based bureaucracy.” To which Morales replies, “Original Bolivians who have been here for a thousand years are many but poor. Recently arrived Bolivians are few but rich.”

Bolivia is Balkanizing, dividing up and being divided on the lines of tribe, race and class. And, hailed by Hugo Chavez, Morales’ Bolivia is not the only place where the claims of ethnicity, tribe and race are conquering the forces of universalism and globalism.

After a disputed election in Kenya, the Kikyu were subjected to ethnic cleansing and massacres by Luo. In Zimbabwe, white farmers are being dispossessed due to their ancestry. In Sri Lanka, the Tamil rebellion against the ruling Sinhalese”to create a Tamil nation, a war that has cost tens of thousands of lives”appears lost, for now.

In Vladimir Putin’s time, Russians have crushed Chechens, confronted Estonians over Russian military graves and war memorials, collided with Ukrainians over the Crimea, and bloodied up the Georgians.

Beijing crushes the Uighurs who want their own East Turkestan and Tibetans who seek autonomy, flooding both lands with Han Chinese.

In Europe, populist anti-immigrant parties, alarmed at a loss of national identities, are striding toward respectability and power. The Vlaams Belang, seeking independence for Flanders, is the biggest party in the Belgian parliament. The Peoples Party and Freedom Party are now Austria’s second and third most popular. The Swiss People’s Party of Christoph Blocher is the largest in Bern. In France, the National Front humiliated the government this week, winning over half the vote in a suburb of Marseilles.

All are unabashedly ethnonationalist. Writes British diplomat Sir Christopher Meyer, “It is useless to say that nationalism and ethnic tribalism have no place in the international relations of the 21st century.”

Meanwhile, global institutions, the United Nations, IMF and European Union, have lost their luster. Czechs”whose president, Vaclav Klaus, regards the EU as a prison house of nations”hold the EU presidency. When the financial crisis hit, Irish, Brits and Germans rushed to bail out their own banks, as did Americans, who rescued Ford, Chrysler, and GM, leaving Toyota, Hyundai and Honda twisting in the wind.

This is economic nationalism.

Inside Ehud Olmert’s cabinet, a rising star is Avigdor Lieberman. What Lieberman’s “merry men” advocate, writes the American Prospect, is “ethnic cleansing: As the creepy name (which translates into ‘Our Home Is Israel’) suggests, Yisrael Beiteinu believes the million-plus Arab citizens of Israel must be expelled.”

Barack won the African-American vote 97 percent to 3 percent over John McCain, and 90 percent to 10 percent over Hillary Clinton in the later primaries. McCain ran stronger than George W. Bush only in Appalachia, the laager of the Scots-Irish.

In Jerry Z. Muller’s “Us and Them: The Enduring Power of Ethnic Nationalism,” in Foreign Affairs, his thesis is summarized:

Americans generally belittle the role of ethnic nationalism in politics. But … it corresponds to some enduring propensities of the human spirit. It is galvanized by modernization, and … it will drive global politics for generations to come. Once ethnic nationalism has captured the imagination of groups in a multiethnic society, ethnic disaggregation or partition is often the least bad answer.

Disaggregation or partition, the man said.

Are we really in a post-racial America, or is our multicultural multiethnic America, too, destined for Balkanization and break-up?

My popularity on television and the internet has led a very small money manager to use his popular financial blog to promote his fledgling business by attacking the recent poor performance of my long-term investment strategy. The post is causing quite a stir and compels me to provide some badly needed context.

To achieve his ends, this individual has distorted much of what I have been saying and writing, and has twisted the facts to support his own preconceived conclusion. In essence, his piece is nothing more than an overt advertisement (and a highly deceptive one at that) to use my popularity to advance his career. In so doing he has given my critics, particularly some who have been embarrassed by their roles in the “Peter Schiff was Right” video, their moments of retribution. In addition, some members of the press who have never been among my greatest fans are seizing the opportunity to discredit me as well.

<object width=“320” height=“265”><param name=“movie” value=“http://www.youtube.com/v/2I0QN-FYkpw&hl=en&fs=1”>

<embed src=“http://www.youtube.com/v/2I0QN-FYkpw&hl=en&fs=1” type=“application/x-shockwave-flash” allowscriptaccess=“always” allowfullscreen=“true” width=“320” height=“265”></embed></object>

The crux of the blogger’s arguments are that my beliefs in “decoupling, hyperinflation, and that the dollar is going to zero” have been completely discredited by the events of 2008, and that the resulting investment losses suffered by my clients last year confirms the fatal flaws in my approach.

In addition to mischaracterizing many of my beliefs, he also is confusing short-term market fluctuations with long-term economic trends.

First of all, the hyper inflation issue is a straw man at best. While I often talk about the possibility of hyper inflation, I have always said that it would be a worse-case scenario that would play out over many years. The fact that it did not appear in the first year of the economic crash (2008) does not invalidate my position. I have always maintained that this worst-case scenario will likely be avoided by what will ultimately be a dramatic shift in policy once our leaders come to their senses. However, until then the dollar will likely lose a substantial portion of its value.

Second, I never said that the dollar would go to zero, either in 2008 or any year thereafter. I have said that in the event of hyper inflation the dollar’s value would approach zero. My actual forecast in my book “Crash Proof” was that the Dollar Index would fall to 40 (currently about 85), with a realistic worst case scenario, assuming very high but not hyper inflation, of 20 or lower.

Third, the blogger points out that because the decoupling theory (foreign economies improving while the U.S. falters) that I wrote about in Crash Proof has yet to occur, that the theory itself was ridiculous. In my book I wrote that this process would not occur overnight, that initially our creditors would come to our aid, and in so doing our problems would become manifest abroad. I wrote that it would take time for the world to realize that what had been decoupled from the economic train was not the engine but the caboose. In fact, that is precisely the way it is playing out.

Chapter Ten of Crash Proof is specifically focused on the need to keep funds liquid to take advantage of the buying opportunity that would initially develop once our stock market began its collapse. I specifically mentioned that when U.S. stocks began to fall, we could expect sympathetic declines overseas. While I did not know the precise timing of those events, I advised readers to prepare.

I did not expect the huge dollar rally of 2008. But to discredit my long-term view of the dollar based on an eight month move is absurd. So while I believed that a weak dollar would cushion the temporary decline I expected in foreign stocks, a strong dollar ended up exacerbating it. In the meantime, I believed that the high dividends these stocks were paying would make it easier to ride out any correction. The problem was that the dollar fell so far leading up to the crisis (in 2005-2007) that by the time the crisis finally erupted the dollar was poised for a bounce.

Central to the argument that my investment thesis is wrong is the belief that the crisis is over or that the recent trends will continue until it is. But the crisis is just beginning and the movements thus far in the dollar, commodities, and foreign stocks, are mere head fakes. Once the speculators have been flushed from the markets, the underlying long-term trends I have been following should return in earnest.

To illustrate the flaws in my investment strategy the blogger has posted a client’s statement that shows a loss in excess of 60%. In addition, he claims to know of other Euro Pacific clients who have experienced similar losses. The inference of course is that most, or all, of my clients must have suffered similar losses, and the existence of such losses proves that I am wrong. In fact, some have gone a step further, claiming that such losses prove that I am a fraud.

First let’s deal with the one client’s account. I have been following several key investment themes for the past ten years. The basis for my strategy is that recent U.S. prosperity has been false, and that the consequences of the bursting of our bubble economy would ultimately play out in a substantial decline in the value of the U.S. dollar, higher commodity prices, the re-monetization of gold, and foreign equities substantially outperforming U.S. markets. From an investment perspective, those themes played out extremely well in the eight years from 2000-2007. Recently we have seen a sharp, and I believe temporary, reversal of these trends. Those that came late to the party (at least based on where we are today) now have to ride out a particularly difficult correction.

For example, the account in question belongs to the son of a long-standing Euro Pacific client, who is still adding funds to his accounts. Without specially commenting on the performance of the father’s account, it must have been compelling enough to finally persuade the son to come on board himself in early 2008. However, as is often the case, by the time he came on board, foreign stocks and commodities were about to sell off, and the dollar was about to begin its unexpected rally. Following such a sharp correction, the son now regrets his decision and must blame me for my part in helping him make it.

Perhaps as a stockbroker I should have persuaded the son to wait for a correction. However, while this clearly would have been the right call with the full benefit of hind-sight, it was certainly not as clear given the information I had at the time. However, I never held myself out to be a market timer. My advice was always geared to long-term investors. Given the thousands of clients that I have, and the large number who joined near the recent dollar peak and market tops, it’s no wonder that a few have contacted this blogger to complain; especially since he has actively sought them out. Of course, the fact that the overwhelming majority of my clients are not complaining, to him or anyone else for that matter, says a lot more about what is really going on.

To the extent that the long-term trends I have been following continue, I am confident that even those whose short-term timing was bad will still do well in time. This is especially true if they take advantage of this pull back by adding to their accounts, either with new funds or by re-investing their dividends. However, to examine the effectiveness of my investment strategy immediately following a major correction by looking only at those accounts who adopted the strategy at the previous peak is unfair and distortive.

Since I have been advising investors to follow these trends for ten years, I will leave it to the public to draw their own conclusions as to how long-term followers of my strategy have fared. However, for those who only recently adopted my approach in 2007 or 2008, the road has been a lot bumpier than they or I thought it would be when they climbed on board. Yet if these long-term trends re-emerge, though the journey may be different than planned, the ultimate destination will remain the same.

The blogger in question implies that all of my clients are down by levels similar to the account he cites. He has asked me to refute his allegations by providing broader performance figures for more clients. But, since Euro Pacific Capital is a brokerage firm and not a Registered Investment Advisor, I am prohibited by regulators from providing any details on the investment performance achieved by my clients. The blogger in question makes his challenge knowing full well that I am legally prevented from accepting it. He then uses my failure to refute his false claim as validating its accuracy.

In addition, to look only at the performance of foreign stocks, while ignoring other aspects of my investment strategy only tells part of the story. What about gold, foreign bonds, short positions in financials, home builders and subprime mortgages (or merely avoiding long exposure to those sectors), or other investments people have made, either at Euro Pacific or elsewhere based on my insights? What about dividends earned, or gains realized on closed positions?

Mainstream economists, journalists, and investment professionals have never liked my message and have never resisted the temptation to shoot the messenger. When my investment strategies were performing well, I got little credit for it. Instead, all the attention was focused on the apparent failure of my dire economic predictions to materialize. Now that the economy is collapsing along the lines that I correctly forecast, criticism is being focused on the recent poor performance of my investment strategy (a fact that I have never tried to hide). Of course by the time my investment strategy is once again in step with my economic forecasts, an event that I believe will occur sooner than most people think, it will likely be too late for most people to do adopt it.

My critics have often referred to me as a stopped clock. I believe that the accusation is best leveled at the accusers. Having been wrong for so long, they are now enjoying their brief moment in the sun. They should enjoy it while it lasts. For now, they are creating fodder for some future “Peter Schiff was Right” piece where those who now criticize my investment performance will look just as foolish as those who once criticized my economic forecasts.

The Macpherson Report on the police investigation of the 1993 murder of black teenager Stephen Lawrence was published in London in January 1999. Ten years on, it is continuing to have major repercussions for British jurisprudence and society.

Around 10.30 p.m. on 22 April 1993, 19-year-old Stephen Lawrence was standing with a friend at a bus stop in the London suburb of Eltham. A minute or two later, he was lying where he had collapsed after fleeing five assailants, one or more of whom had stabbed him in the chest and arm, severing major arteries. Because one of the assailants had shouted “What? What, nigger?” during the unprovoked attack, it was naturally assumed that his murder had been racially motivated.

Five white men were arrested and two were charged, but there was insufficient evidence and the case was abandoned. Three years later, Stephen’s family initiated a private prosecution against the five men. The trial was held in the largely Afro-Caribbean suburb of Elephant and Castle, with dozens of Black Muslims lining up outside the court to intimidate and assault the accused. The five refused to answer questions, as was their legal right; the case against the original two men had been dropped prior to the trial, and the judge at the trial acquitted the remaining suspects after finding that identification evidence was inadmissible.

The disappointing verdict turned an already disagreeable situation into something extraordinarily noxious. It had long been darkly hinted by radicals that British society was riddled with virulent racism, and that the Metropolitan Police simply did not care about crimes against black people. Blacks and police had often clashed violently in the past, most notoriously at Brixton, Toxteth and Broadwater Farm (PC Keith Blakelock was killed by a mob at the latter event, eliciting the infamous remark by black Labour MP Bernie Grant that “the police got a bloody good hiding”). Now, their inability to find (or convict) the killers was for many conclusive proof of police racism. That the suspects were obviously deeply unpleasant”inadmissible video evidence showed them joking about stabbing people, and two have subsequently been convicted for a racially-aggravated attack on another black man”made it very difficult for many to understand why nothing was being done.

Irresponsible media fed the flames gleefully. Contemporary newspaper headlines included “The Face of Hate,” showing the suspects lashing out at (unpictured) Black Muslims during what must have been a terrifying approach to the magistrate’s court; “Eltham”Scene Of The Crime, Streets Where Race Hatred is the Norm,” in which the mostly middle class suburb with its attractive medieval palace was portrayed as a kind of mini-Belsen; and “Murderers: The Mail accuses these men of killing. If we are wrong, let them sue us.” The attitude of the Daily Mail, a downmarket conservative paper, was curiously aggressive”curious, because the Mail at that time was being criticized for supposedly racist reportage.

The incoming Labour government set up a special committee under the chairmanship of Sir William Macpherson, a retired judge and Conservative-voting Scottish aristocrat. Sir William was hopelessly out of his depth, and was outgunned by the other committee members”Ugandan-born John Sentamu (who has now miraculously metamorphosed into the Archbishop of York), Richard Stone, the then chairman of the Jewish Council for Racial Equality, and one Tom Cook, who listed “educating children in anti-racism” as one of his “particular concerns.”

It was unsurprising that the eventual report not only blasted the police for incompetence (deservedly), but averred that the force was “institutionally racist””the first time that Stokely Carmichael’s tendentious terminology had been recognised as an objective term in a UK government publication. There was, the report averred, a “canteen culture” of racism in the police. Not only the police, but the judicial system, the National Health Service, schools, local government and civil service were all deemed prone to such racism. Macpherson made a total of 70 recommendations, a few so ambitious that the government distanced itself rapidly from them”including abolishing the ancient safeguard of “double jeopardy” (which provided that suspects could not be tried twice for the same crime using the same evidence”although this provision was subsequently watered down in 2003) and criminalizing “racist” statements made in private. Others were adopted”such as the recommendation that any crime perceived by its victim or a witness to have been a racist crime should be regarded as such thenceforth and fast-tracked. Many of the other recommendations, such as amending the National Curriculum to “value cultural diversity,” were already de facto policy.

Many criticised Macpherson’s conclusions and called him a fool”he admitted later to being “deeply wounded” by the vitriol. But he had released the bacillus, and the infinitely extendable concept of “institutional racism” has become part of Britain’s cultural wallpaper. It has been used to assail every institution from the Royal Family and the Church of England down to even the Labour Party, every profession and area of society. Now and for the foreseeable future, everything that makes Britain what it is lies under the subliminal suspicion of being attainted with injustice or rank hatred, and is increasingly subject to censure and interference by government.

The penitential, neurotic tone was set by a senior London policeman, John Grieve, when he wrote a 1984-style “confession in the Daily Telegraph“”I am a racist. I must be because Sir William Macpherson of Cluny said that I am…I”ve found inside myself evidence of subtle prejudice, preconception and indirect discrimination. I”m for change inside myself and in the behaviour of others”

Initiatives were announced to attract ethnic minorities into the police, with ambitious “targets” (which the government maintains are not quotas). These targets have proved unworkable across the police and all other institutions and professions, and are a constant cause of angst, backbiting, distrust, expense and acrimonious legal proceedings.

The report’s immediate effect was to make policing more difficult, by exacerbating existing distrust between blacks and the police”and these effects linger a decade on. There has been a steady demoralization and departure of experienced officers who are declining to sign back on when their contracts expire, and an upsurge in long term sick leave. There has been a huge rise in gun and knife crime essentially because police are reluctant to stop and search black youths. Macpherson underlies the allegations made by ethnic minority police officers who have experienced career obstacles. “Institutional racism” has migrated into the public consciousness and academic publications, from where it will exercise its eldritch power for decades to come.

There continue to be case-specific echoes”the police paid Stephen’s friend £100,000 compensation in 2006. Allegations of corruption against the officers concerned were investigated (they were exonerated). In 2007, a Stephen Lawrence Prize was introduced for ethnic minority architects. In 2008, a Stephen Lawrence Centre was opened in southeast London, and was promptly vandalized (the automatic suspicion that the vandalism was racially motivated was scotched by CCTV footage). There are spasmodic TV documentaries, plays and articles, and reports of “new evidence” which never amount to anything. Like Steve Biko, Stephen has passed into national mythology as a perennially young, illimitably poignant symbol of black grievance against “The Man””an inappropriate and melancholy fate for a pleasant young man who was, his mother said, uninterested in race (“all he saw was the person”).

Macpherson‘s 10th anniversary was marked on 19 January with a much-reported speech by Trevor Phillips, the Guyana-born “chair” of the Commission for Equalities and Human Rights, a body paid £70m annually by Whitehall to centralize Labour’s cosmic battle against the “forces of conservatism.” Phillips has forged a lucrative career out of race relations. His present salary is £110,000 per annum, and he runs a consultancy that controversially makes money out of high-profile race cases. He is an ex-president of the National Students Union, ex-chairman of the Commission for Racial Equality, a friend of Peter Mandelson and Tony Blair, and a holder of the Légion d”Honneur who famously used to keep a bust of Lenin on his CRE desk”despite a series of inflammatory gaffes for which he has had to apologise.

But his rhetoric has now become more nuanced, even if the underlying motivations and effects remain the same. He has become an opponent of the multiculturalism he once so enthusiastically promoted”thereby being accused by Ken Livingstone of “pandering to the right” so much he would “soon join the BNP.”

In his 19 January speech, Phillips praised the police for the “progress” they had made since 1999, and said that he now favoured forgetting “institutional racism”””The use of the term was incendiary. It rocked the foundations of the police service and caused widespread anguish in government.” But “I am not saying that institutional racism … has been obliterated … Public institutions are not now exonerated with a single sweep. Our mission has not been achieved.” For example, parliament remains outrageously “white, straight and male.” There was still “systemic bias” and a need for a “national debate on equality.” Now there’s a radical idea”and one that will keep Mr Phillips enjoyably busy for many years to come.

Derek Turner is the editor of the Quarterly Review.

Same as the Old New Deal

Happy days are here again”not for America, but for meddlers promising to scheme the nation out of the doldrums. Ideas that would have been derided during the presidencies of Bill Clinton (“the era of big government is over”), George H.W. Bush (“A president…. must see to it that government intrudes as little as possible in the lives of the people”), and Ronald Reagan (“government is not the solution to our problem; government is the problem”) are now de rigueur. That those presidents were unfaithful to their rhetoric does nothing to blunt the sense that they strode the stage during a different act. America has again crossed a Rubicon. Not since the Great Depression have cranks had the ear of the nation as they do now.

For much of the past year, a strange breed of past-pining progressive has demanded a “new” New Deal. Time pictured an in-color Obama on its black-and-white cover as a bespectacled Franklin Roosevelt triumphantly titling his cigarette upwards. Politico labeled Obama’s program “a twenty-first century New Deal.” Paul Krugman dubbed the new president “Franklin Delano Obama” in the New York Times and contended that the New Deal had much to impart to Barack Obama, particularly the lesson that the 32nd president’s “economic policies were too cautious.”

The “new” New Deal recidivism reveals a sclerotic movement stuck in the past. The ubiquitous prefix “new” stamped on any old program reflects the movement’s horror that its ancient pedigree might be discovered. What self-respecting “progressive” xeroxes the past to boldly remake the future? The old New Deal was a mish-mash of the populist, progressive, and social gospel movements that antedated it. If the New Deal’s abandonment of the gold standard did not spark flashbacks to William Jennings Bryan, and its National Recovery Administration did not immediately bring Woodrow Wilson’s War Industries Board to mind, then its very name should have jogged memories. The Madison Avenue-style marketing ploy, an amalgamation of Woodrow Wilson’s “New Freedom” and Theodore Roosevelt’s “Square Deal,” served as a clue to the atavistic nature of the New Deal. The “new” New Deal, then, recycles a 75-year-old political gimmick that, even when first unveiled, was stale.

There is nothing inherently wrong with not reinventing the wheel. But when the wheel is a concrete rhombus supported by popsicle-stick spokes and a gingerbread axle, then, by all means, invent a new wheel. The New Deal failed. It intensified and prolonged the Great Depression. The frenetic spending and erratic meddling made the Great Depression longer and more painful than other contractions in American history and the contemporaneous depressions experienced in other industrialized nations. Who, but a masochist, would seek to relive the New Deal?

Parallels abound. Both Roosevelt and Obama enjoyed strong Democratic majorities in Congress on day one. Both presidents confronted financial crises and contracting economies”and the openness to crank solutions that invariably accompany tough times. “This nation is asking for action, and action now,” Roosevelt declared on inauguration day. Channeling his distant predecessor, Obama proclaimed in his inauguration address, “The state of the economy calls for action, bold and swift.” But what action? Not until after Election Day did the “action” or “change” the candidates promised take on specificity. Candidate Obama characterized the Bush administration as an “orgy of spending and enormous deficits.” Candidate Roosevelt lambasted the Hoover administration for adding “bureau on bureau, commission on commission.” Said Roosevelt during the 1932 campaign, “I accuse the present administration of being the greatest spending administration in peace times in all our history.” But upon taking office, presidents 32 and 44 upped the spending ante. When confronted with the Depression’s recalcitrance to the New Deal’s spending, Roosevelt invoked a magic word, “Hoover,” to absolve himself of responsibility. One needn”t be blessed with clairvoyance to envision Obama using the name “Bush” to similar effect for years to come as his policies fail.

The inconvenient truth is that Bush and Obama, like Hoover and Roosevelt, are more alike than different. Just as Hoover’s ventures into social engineering and a managed economy not only softened up America to Roosevelt’s New Deal but also undercut the credibility of Republican opposition to it, Bush’s big-government “conservatism” has enabled Obama’s designs. This is the historical parallel that retread enthusiasts of a “new” New Deal want everyone to forget:

The New Deal, and the “new” New Deal, actually began during Republican administrations.

“Advocates of the free market must confront the fact that both the Great Depression and the current financial crisis were preceded by years of laissez-faire economic policies,” Katrina Vanden Heuvel and Eric Schlosser insisted in the Wall Street Journal during the heat of 2008’s presidential campaign. This narrative, of too much freedom hampering private commerce, worked so well as a brickbat against capitalism during the Great Depression that it has been called for an encore in the wake of the Bush presidency. Though an agnate economic vision binds Hoover and Bush, the source of that vision owes little to free-market economics.

Continuity, rather than renewal, marks the transition from Bush to Obama. Spotlighting the linkage is the banker bailout. What Bush propelled from the White House, Obama advanced on Capitol Hill. The 43rd president spent the first $350 billion. The 44th president will spend the second installment. Rather than “years of laissez-faire economic policies,” the Bush presidency extended Big Brother’s hand out to senior citizens through an expensive prescription-drug entitlement, inside political campaigns through restrictive campaign-finance laws, and into previously private businesses”resulting in the nationalization of airport security and the partial nationalization of nine of America’s largest banks, two American auto-manufacturing giants, and the largest insurance company in the world. Not since the Hoover-Roosevelt years has there been such a drastic reorientation of federal economic policy.

For Obama to break from the last eight years of government gluttony, he might outline a series of spending cuts or identify a federal department for elimination. Instead, the president champions the most expensive piece of legislation ever. The stimulus package, nicknamed the American Recovery and Reinvestment Act, approaches one trillion dollars”roughly the sum total of federal receipts when George H.W. Bush assumed office. The congressional summary of the 647-page stimulus package highlights $6 billion for rural broadband internet access, $400 billion to NASA for global warming research, $2 billion for car battery research, $650 million in coupons to convert old televisions from analog to digital, $600 million for alternative-fuel vehicles for the federal government, $350 million to the department of defense to research renewable energy fueling weapons systems, and $20 billion to “modest-income families” for “nutrition assistance.”

Just as continuity rather than conflict marks the transition between George W. Bush and Barack Obama, it is helpful, though anathema, to speak of the Hoover-Roosevelt years. As Murray Rothbard pointed out in America’s Great Depression,

For if we define “New Deal” as an anti-depression program marked by extensive governmental economic planning and intervention”including bolstering of wage rates and prices, expansion of credit, propping up of weak firms, and increased government spending (e.g., subsides to unemployment and public works)”Herbert Clark Hoover must be considered the founder of the New Deal in America. Hoover, from the very start of the depression, set his course unerringly toward the violation of all the laissez-faire canons.

The federal public-works projects that historians credit Roosevelt with jumpstarting actually began under his maligned predecessors. The Hoover Dam, one would think, would be an obvious reminder. As evidenced by the Reconstruction Finance Corporation, the alphabet-soup of federal agencies planning America out of the depression also predated Roosevelt. Like his successor, Hoover was a hands-on interventionist. He signed the Smoot-Hawley Act that skyrocketed tariff rates. He more than doubled the top marginal income-tax rate from 24 to 63 percent. What is laissez faire about all that?

“To scoff at Hoover’s tragic failure to cure the depression as a typical example of laissez-faire is drastically to misread the historical record,” Rothbard noted in America’s Great Depression. “The Hoover rout must be set down as a failure of government planning and not of the free market.” But it wasn”t. And the louder voices drowning out the more reasonable ones, such as Rothbard’s, has resulted in a remake of the New Deal with Barack Obama starring as the hero FDR and George W. Bush playing the villain Hoover.

In New Deal historiography, facts and ideology collide”and ideology wins. The mythic Hoover is a devoteé of free-market economics rather than a longtime progressive. The New Deal of fable slays the Great Depression. These dubious postulates, by repetition and volume, have been established as the dominant historical narrative: capitalism made a mess, big-government liberalism cleaned it up.

Whatever inspiration Franklin Roosevelt (or his 21st-century imitator) provided to the downtrodden, his policies did not end hard times. Ill-thought-out programs paid farmers to uproot crops during a drought and destroy livestock amid hunger, jailed a tailor for pressing a suit of clothes for a nickel less than the competition, and separated the dollar’s value from gold and attached it to presidential fiat. Was it any wonder that farms turned into dust bowls, businesses closed, and lending all but ceased? What the disease didn”t kill, the medicine did. The Dow Jones Industrial Average, the gross domestic product, and unemployment didn”t meet pre-crash levels until the Eisenhower presidency, the first year of Roosevelt’s third-term, and midway through World War II, respectively. In other words, Roosevelt had been in office longer than any other president by the time economic indicators recovered.

The New Deal failed terribly as an economic program but succeeded wildly as a public relations gambit. That is why unimaginative progressives seek to revive it. That is why they are getting away with it. The clear lesson is that losing yesterday’s historical debate may guarantee failure in today’s political debate.

The price America paid for the New Dealers winning the political battle during the Hoover-Roosevelt years was a more painful, deeper depression. By losing the battle over the history of the New Deal, we condemn ourselves to more of the same during the Bush-Obama years.

Daniel J. Flynn, the author of A Conservative History of the American Left, blogs at www.flynnfiles.com.

Photo: Time Magazine, Nov. 24, 2008.

House Republicans have put up a united front in opposing Obama’s stimulus package. Writes conservative columnist Robert Stacy McCain “Man, if all it took to get Republicans to vote conservative was to elect a Democratic president, this is a change I can believe in.” Indeed. Yesterday’s “we must support the president” big government economics is rightfully seen today as “socialism.” And whether out of principle or partisanship, it’s refreshing to see Republicans standing on conservative principle once again.

<object width=“425” height=“344”><param name=“movie” value=“http://www.youtube.com/v/GglhyZQzCYA&hl=en&fs=1”>

<embed src=“http://www.youtube.com/v/GglhyZQzCYA&hl=en&fs=1” type=“application/x-shockwave-flash” allowscriptaccess=“always” allowfullscreen=“true” width=“425” height=“344”></embed></object>

When House Republicans unanimously voted against President Obama’s $800 billion stimulus package, was this the beginning of a conservative rebirth for the GOP?

Jason Caffey seems to have won the Darwinian lottery of life. In two ways in fact. The first is that Jason Caffey won in his own inheritance of genes. Genes good enough (allied with a great deal of sweat and effort of course) top get him into the NBA for near a decade:

Caffey played nine years in the NBA for the Chicago Bulls, Golden State Warriors and Milwaukee Bucks.

The second way is that he’s managed to pass on those genes, or rather some share of them,. to an impressive number of others:

An Atlanta judge has ordered the arrest of former NBA player Jason Caffey. Jason who used to play for the Milwaukee Bucks, Golden State Warriors, and the Chicago Bulls, is accused of failing to pay more than $200,000 in child support and legal fees to Lorunda Brown and her lawyer. Lorunda has a six year-old son with Caffey; she is one of eight women and her child is one of ten children fathered by Caffey.

Ten children by eight different women? That’s certainly a success by the limited standards of Darwinian thought. Or at least success in one of the available strategies. For as Darwin pointed out, the game of life is to have as many descendants as possible, to spread one’s seed. That the successful strategies differ for men and for women is one of the things that provides the tension to life. Alpha males such as Caffrey might succeed by impregnating as many women as possible but women (to say nothing of beta males like myself) do better by having fewer and paying greater attention to their upbringing, investing more in each than opting for a scattergun approach.

It’s also worth noting that in this, the bicentenary of Darwin’s birth, that we have a legal system expressly designed to make sure that those alpha males don’t in fact get the opportunity to pursue their strategy without censure. Child support is, after all, a way of making sure that the greater support that maximises a woman’s reproductive success is available, whatever the strategy the male is following.

I will admit though what I really like about the story is precisely that line “ten children by eight different women”. Whatever the truth or not of Darwin’s theory we as a society don’t in fact act as if it is the be all and end all of life. For we have not just that child support requirement, we also have quite a social constraint about that sort of behavior: not just deadbeat dad behavior, but that sort of spreading the seed around behavior.

A strict reading of Darwinian texts would lead us to the thought that Jason Caffey’s a winner for having all these children. As I say, whatever Darwin said, that’s not in fact the way that our society views someone who has that number of children by so many different women and most certainly not the way we view, or treat, those who won’t follow through with the support. So whether Charles was right or wrong we have evidence that we don’t in fact live in a Darwinian society.

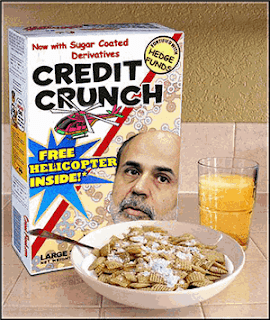

Ben Bernanke Wants To Throw Dollar Bills Out of Helicopters

People who want to find out what Federal Reserve Board Chairman Ben Bernanke has in mind for the economy need to read some history. Bernanke declares himself a “Great Depression buff,” and as a professor at Princeton, he published an entire book devoted to the subject. The work in question, Essays on the Great Depression, published by Princeton University Press in 2000, offers vital clues to his thinking. From his interpretation of this prior disaster, he draws a key conclusion: policymakers must at all costs prevent deflation. Unfortunately for the economy, Austrian business cycle theory gives us strong reason to reject both Bernanke’s historical analysis and his policy recommendations.

To understand Bernanke’s argument, though, we need to go back to an earlier book by an economist even more famous than Bernanke. Milton Friedman, the leading economist of the Chicago School, launched in the 1960s an all-out effort to defend the free market against its detractors. (Austrian School economists like Murray Rothbard contend that Friedman’s support for the market did not go far enough.) In a major battle in his campaign, Friedman challenged the prevailing Keynesian account of the Great Depression. As Keynes and his many followers saw matters, a free market might fail to generate full employment. Investors, in the grip of arbitrary “animal spirits”, can become skittish and reluctant to invest. If they do so, aggregate demand will not suffice to sustain full employment. Keynesians argued that the government must then step in to take up the slack. The ideal, if ideal it was, of laissez-faire, must be banished to the dust heap; government plays an indispensable role in keeping the economy stable.

Not so, said Friedman. In a famous book that he co-authored with Anna J. Schwartz in 1963 (also published by Princeton), A Monetary History of the United States, 1867-1970, Freidman argued that the Great Depression did not stem from a fundamental flaw in capitalism. Quite the contrary, the blame rested on the government. Specifically, the Federal Reserve System began to deflate in 1928, in an effort to curb stock market speculation. The effort succeeded only too well, when the market crashed in October 1929. Even worse, the Fed, faced with bank panics in 1930 and 1931, contracted the money supply even further, beginning in March 1931. Here precisely lay the cause of the Depression: had the Fed instead expanded the money supply, the economy could readily have surmounted the stock market crash and the ensuing downturn. We could avoid Keynesian intervention, which in any case Freidman argued could not be timed to have the right effects. There was nothing amiss with the free market that correct monetary policy could not cure.

Keynes, by the way, anticipated expanding the money supply to cure depressions. In an open letter to President Roosevelt published in the New York Times, December 31, 1933, he said, “Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt.” In Keynes’s view, more money will not by itself help if investors and consumers hoard it.

We need Friedman to understand Bernanke for a simple reason: Bernanke adopts and expands Friedman’s thesis. (Keynes hardly figures at all in Bernanke’s book.) We do not have to guess about this: in a tribute delivered in November 2002 to honor Friedman’s ninetieth birthday, Bernanke said: “Today I”d like to honor Milton Friedman by talking about one of his greatest contributions to economics … to provide what has become the leading and most persuasive explanation of the worst economic disaster in American history, the onset of the Great Depression, or, as Friedman and Schwartz dubbed it, the Great Contraction of 1929-33.”

In his own book, Bernanke faithfully follows the Master. Friedman and Schwartz concentrated on the United States; but when one takes into account the experience of other countries, Bernanke avers that the lesson that Friedman taught us gains further support. Specifically, countries that expanded their money supply, abandoning the gold standard in order to do so, recovered from the depression faster than those more reluctant to detach their currency from gold.

[Photoshop artistry by Bob Rooney]

As Bernanke shows himself well aware, a glaring problem confronts this account, which Friedman failed to solve. Why should a fall in the money supply cause the economy to collapse? So long as prices, including wages, can fall freely, will not the economy adjust to whatever amount of money exists? As Bernanke states the problem: “Why did the process of adjustment to nominal [i.e., monetary] shocks take so long in interwar economies?”

He endeavors valiantly to resolve the problem, but his efforts cannot be declared a success. He revives a theory that stemmed from the fertile brain of Irving Fisher. Under deflation, debtors may find it much harder to meet their obligations than they anticipated. Dollars under deflation increase their purchasing power, so the nominal amount of a debt becomes more burdensome. Perhaps here lies the key to the onset of depression.

A crushing objection derails Fisher’s theory. Bernanke states the point well: “Fisher’s idea was less influential in academic circles, though, because of the counterargument that debt-deflation represented no more than a redistribution from one group (debtors) to another (creditors). Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistribution should have no significant macroeconomic effects.” Bernanke thinks he can rebut this objection through an appeal to “agency theory,” but his argument, at best highly speculative, seems to me unsuccessful. I shall spare readers the complications, but those who wish to judge for themselves should consult Bernanke’s book.

Bernanke wisely does not rely totally on Fisher. He also points out that monetary wages often failed to fall in response to deflation. This meant a rise in real wages. Does this not readily explain why unemployment persisted? Elementary economics tells us that if suppliers offer more of a good at a given price than buyers want to purchase, some of the supply will fail to be sold. If the good is labor, the case is the same: a rise in real wages will cause unemployment unless employers decide to purchase more labor at the higher price.

But if Bernanke says this, a new problem confronts him. He has not explained why prices and wages fail to adjust; he thus leaves a gaping hole in his account of the depression. He appeals at one point to Fisher’s debt-deflation hypothesis to help account for price rigidity; but his attempt seems contrived. Matters do not improve when, in a later paper, he abandons the view that rising real wages caused unemployment. “Maybe Herbert Hoover and Henry Ford were right: Higher real wages may have paid for themselves in the broader sense that their positive effect on aggregate demand compensated for their tendency to raise costs.” Now he has no explanation at all for the continued unemployment of the 1930s.

Bernanke’s problems lie deeper. Neither he nor Friedman really has a theory of the Great Depression. Rather, they have a collection of data: “Look at the correlations, “ they in effect say, “between a falling quantity of money and economic doldrums. Who can doubt that deflation causes depression?” But they have nothing better than stabs at an explanation to link the two.

This theoretical failure does not deter Bernanke from policy prescriptions, and therein lies the main danger of his monetarist account of the depression. In another speech delivered in November 2002, (a significant month for him) Bernanke said that the Fed should act aggressively to counteract deflation, though at that time he did not think it posed significant danger to the United States. If a deflation should occur, the government can always print enough money to get us out. “We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.” In a deflation, consumers must get extra money; Bernanke referred in this connection to “Milton Friedman’s famous “helicopter drop” of money.”

But what makes this policy dangerous? The answer lies in another book published in 1963, Murray Rothbard’s America’s Great Depression. In it, Rothbard developed and extended the Austrian theory of the business cycle, developed by Ludwig von Mises and Friedrich Hayek, and applied it to the American example. The book has not attracted nearly the attention among mainstream economists of Friedman’s more celebrated work, although Hayek told me in 1969 that he thought Rothbard had done an excellent job. But, unlike Friedman and Bernanke, Rothbard offers more than a slew of statistics. He provides a convincing theoretical of the depression, along with radically different policy suggestions.

The Austrian account starts from a standard point; in the free market, consumers” preferences determine the goods to be produced. If people want, for instance, more “reality TV shows,” then, sad to say, they will get exactly that. People’s preferences determine much more than the particular goods that the economy will produce: they also establish the balance between consumption and capital goods industries. People face a fundamental choice: they can devote resources to make things that immediately gratify them or they can instead aim to produce capital goods that will generate a greater quantity of consumer goods in the future. Other things being equal, people prefer goods right now to goods in the future. Austrians call this phenomenon time preference, and in their view the rate of time preference determines the pure rate of interest in the economy.

“So what?” I fear many readers will be asking. However abstract this may sound, it has the utmost practical importance. Producers use the rate of interest to decide what projects to undertake. A businessman who wants to build a new steel plant, e.g., will compare the profit he thinks he can get with the rate of interest, the cost of the money he must borrow. The lower the rate of interest, the less prospective profit margin he needs to start a new project. In this way, the extent to which people value present goods over future goods controls the amount of investment in new production.

A centralized banking system with fractional reserves can derail this mechanism. If the central bank expands the money supply, this will drive the money rate of interest below the pure rate, determined by time preference. Investors, seeing the money available at a lower rate than before, will hasten to expand production. The economy will boom.

Alas, this cannot continue indefinitely. When the expansion of bank credit ceases, the rate of interest will rise. The rate of time preference has not altered, and this, once the monetary expansion has had its effect, reemerges to determine the interest rate. The fact that the money supply has increased does not change the extent to which people value present goods over future goods. When the rate of interest rises, business investments that relied on the temporarily lower interest rates no longer prove profitable. They must be liquidated; as Austrians see matters, this liquidation of malinvestments constitutes the depression.

Here precisely lies the key divergence between the Austrian theory and nearly all other accounts of the business cycle. In the Austrian view, the government should not impede liquidation of investments that wrongly relied on low monetary interest. Quite the contrary, this process satisfies the wishes of consumers. It redirects resources from capital goods industries to consumer goods, guided by the rate of time preference.

If the government acts in depression to curb deflation, as Friedman and Bernanke urge, increased bank credit will again drive the monetary rate of interest below the pure rate. New malinvestments will occur. Once more, when the expansion ends, projects will require liquidation. The attempt to avoid depression will only generate a more severe depression later.

But, you might ask, what of Friedman and Bernanke’s massive array of data that show a correlation between depression and a contraction of the monetary supply? Rothbard does not deny that deflation occurred in the Great Depression. “At the end of 1930, currency and bank deposits had been $53.6 billion; on June 30, 1931, they were slightly lower, at $52.9 billion. By the end of the year, they had fallen sharply to $48.3 billion. Over the entire year, the aggregate money supply fell from $73.2 billion to $68.2 billion. The sharp deflation occurred in the final quarter, as a result of the general blow to confidence caused by Britain going off gold.” In diametric opposition to Friedman and Bernanke, though, Rothbard contends that the Fed did not bring about this contraction though deliberate policy. The contraction instead reflected the public’s loss of confidence in the expansionary bank system. Through much of the 1920s, the Fed had followed a policy of inflation; and when the boom came to an end, the banking system received, in Booth Tarkington’s phrase, “its well-deserved comeuppance.” Those who read together Bernanke’s and Rothbard’s books will see the difference between an incompletely worked out endeavor to elicit an explanation from data and a fully developed, cogent theory.

Unfortunately, it is Friedman’s explanation, and not Rothbard’s theoretical account, that is informing public policy—and leading Ben Bernanke to believe that he can prevent another Great Depression by running the Fed’s printing press all night long.

David Gordon is a senior fellow at the Ludwig von Mises Institute and editor of its Mises Review.

For all the yammering by talk-radio nitwits and GOP chicken hawks about “supporting the troops,” it’s quite ironic that these same pundits and politicians have had little to say about the many high-ranking troops who support Obama’s decision to close Guantanamo Bay. Throughout, the Bush presidency, I made the point time and again that thanks to talk radio, being a “conservative” now meant never questioning your government so long as a Republican was in charge. To not support the president in a time of war was not only unpatriotic, but anti-military, we heard time and again. Last week these same pundits and politicians not only refused to support their president and his decision during a time of war, but on torture and Guantanamo Bay “ they loudly and boldly opposed the military.

<object width=“425” height=“344”><param name=“movie” value=“http://www.youtube.com/v/ofdILumkd9E&hl=en&fs=1”>

<embed src=“http://www.youtube.com/v/ofdILumkd9E&hl=en&fs=1” type=“application/x-shockwave-flash” allowscriptaccess=“always” allowfullscreen=“true” width=“425” height=“344”></embed></object>